Credit and Loans

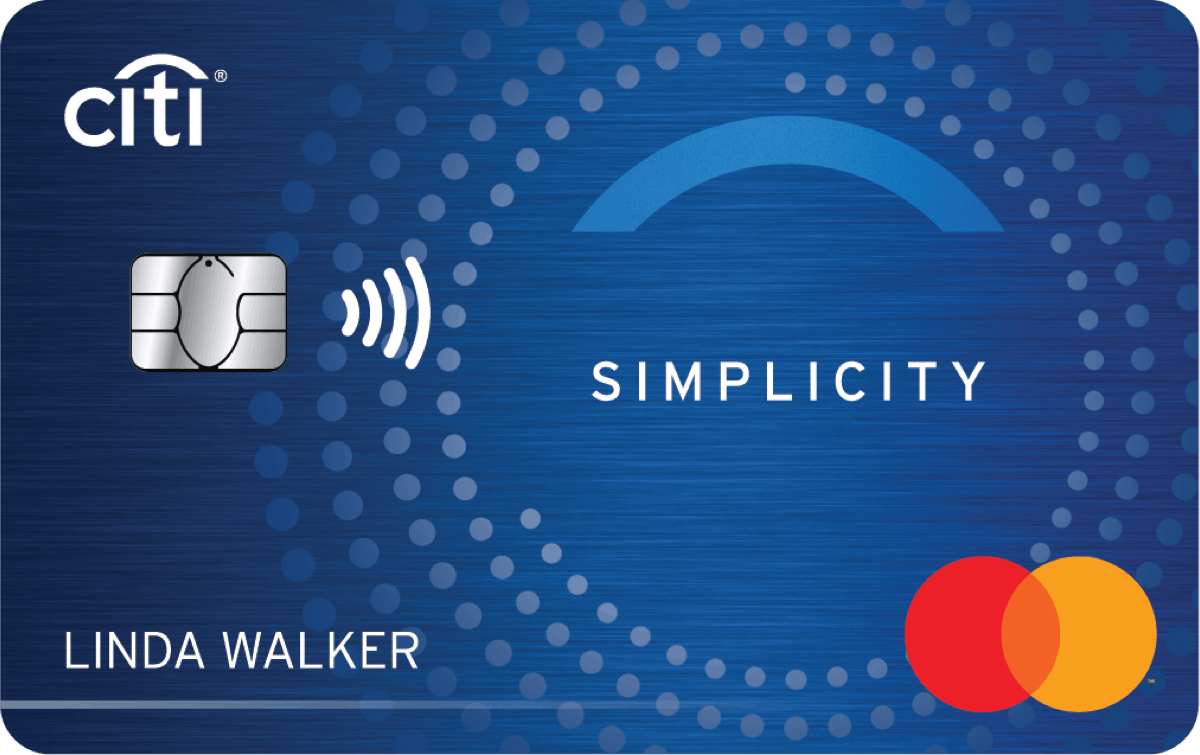

Citi Simplicity® Credit Card: A Smart Choice for Simplicity and Savings

Learn About the Benefits and How to Apply for the Citi Simplicity® Credit Card

Citi Simplicity® Credit Card

0% Intro APR, No Annual Fees, and No Late Fees

- Annual Fee: $0

- Intro APR: 0% for 21 months on Purchases and Balance Transfers

- Balance Transfer Fee: 5% (minimum $5)

- Credit Score: Good to Excellent

How to Maximize the Citi Simplicity® Credit Card

Explore how the Citi Simplicity® Credit Card can help you save money with its long intro APR and simplify your finances with no annual or late fees.

0% Intro APR and No Late Fees: How It Works

With the Citi Simplicity® Credit Card, you can enjoy **0% intro APR** for 21 months on both purchases and balance transfers, giving you more time to pay off your balances without interest charges. Plus, there’s no penalty APR or late fees if you miss a payment.

Citi Simplicity® Credit Card

Enjoy no late fees, no penalty APR, and 0% intro APR for 21 months on purchases and balance transfers.

Get More DetailsHow to Apply for the Citi Simplicity® Credit Card

The application process for the Citi Simplicity® Credit Card is simple and can be completed online. Here’s how to apply and what you need to know before submitting your application.

An Alternative: Discover it® Secured Credit Card

If you’re looking for a card that offers rewards in addition to a simple, no-fee structure, consider the **Discover it® Secured Credit Card, which provides cash back on rotating categories and no annual fee.

Discover it® Secured Credit Card

Earn 5% cash back on rotating categories each quarter (activation required).

How to Apply